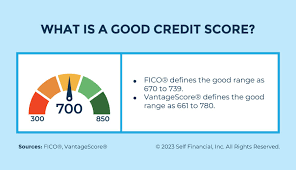

When most people think about qualifying for a personal loan, the first thing that comes to mind is their credit score. A three-digit number seems to define whether you’re “good” or “bad” in the eyes of lenders. But here’s the twist. While a good credit score for personal loan applications is important, it doesn’t tell the full story.

Lenders today don’t stop at that single number. They dig deeper, especially into your repayment history. Why? Well, because how you’ve handled debt in the past is usually the best predictor of how you’re going to manage it in the future.

This blog explores why repayment history is becoming as important as, if not more important than, just having a good credit score, and what borrowers can do to avoid being caught off guard.

Credit Score vs. Repayment History

- Credit Score: A number based on your creditworthiness (taking into account your payment history, credit utilization, age of credit history, credit lines, and new credit applications).

- Repayment History: Your history of paying the loans or credit card dues on time or not. Even a single late payment can linger on your record for years.

Think of it this way:

- Think of that score like a newsy headline.

- The article itself is your repayment history.

Of course, lenders want both, but because the track record of repayment is a better predictor of risk, that’s what often matters more. Stashfin stands out by making personal loans easier to get by using a simple, fully digital process that puts speed and openness first.

Why Lenders Look Beyond “Good” Scores

1. Past behavior predicts future behavior.

While a good credit score may indicate that you have been an all-around responsible borrower, repayment history betrays specific patterns. For instance, if you’ve defaulted on two EMIs in the last year, lenders consider this a red flag, even though your score is still in the “good” range.

2. Scores can be misleading

Credit scores can stay relatively high despite small repayment issues if other factors like credit utilization and account age balance things out. But lenders know that repayment slips, even minor ones, are risk signals.

3. Regulatory shifts encourage deeper checks

Financial regulators in India and elsewhere have been pressuring lenders to rely on credit scores that are more comprehensive. When you have fintech companies providing loans instantly, the repayment history becomes a crucial filter to guard against delinquency.

Case Study: Two Borrowers, Same Score

For instance, suppose Ananya and Rahul have credit scores of 740.

- Ananya has never missed an EMI. She pays off her credit card bills in full and has a fair history of repayment.

- Rahul, in contrast, has missed payments twice this year and tends to pay nothing other than the minimum on his card.

On paper, they look the same. But for lenders, Ananya is the safer horse, and Rahul’s repayment habits are a sign of potential stress, which may counter his good score.

The Borrower’s Blind Spot

A lot of borrowers get shocked when their personal loan applications get declined, even if, to the best of their knowledge, they have a good credit score for personal loan approvals. This usually happens because:

- They underestimate the impact of late payments.

- They don’t realize lenders analyze repayment data month by month.

- They assume once a default is corrected, it stops mattering when, in fact, repayment marks can remain visible for years.

Building a Strong Repayment History

Consider these methods if you want to boost your readiness, other than by credit score:

- Pay on or before due dates: A delay as short as one day is recorded.

- Automate repayments: Schedule auto-debits to avoid missing EMIs.

- Settle remaining debts: Making partial payments can help lower penalties, but it’s not going to save your reputation as being in financial trouble.

- Keep utilization low: Only borrow what you are comfortable that you can pay back.

How Fintech Platforms View Repayment History

With the increase in online lenders, the screening process is now more data-based. Platforms do not just account for scores provided by credit bureaus, but they also analyze cash flows, consistency in repayments, and even digital footprints

For example, if a borrower applies for a short-term loan online, repayment records from previous loans on that same platform can weigh heavily in the decision, even more than their general credit score.

Repayment History and Loan Terms

If you are approved with an imperfect repayment history, lenders might:

- Charge higher interest rates.

- Add stricter repayment conditions.

- Offer smaller loan amounts.

Conversely, borrowers with good credit and a solid history of repaying debts often get:

- Lower interest rates

- Faster approval times

- Higher loan limits

- Exclusive deals like pre-approved loans

This is the evidence that loan discipline not only ensures approvals but also saves money. A ₹2000 personal loan can sometimes help with urgent needs, showing that credit isn’t always about big amounts but about getting help when you need it.

The Future of Credit Assessment

The lending environment is changing rapidly. With artificial intelligence and big data, lenders are veering into “behavior-based credit models.” This means:

- They’ll be keeping a closer eye on your repayment history than ever.

- Assessments could also be informed by non-traditional data, such as utility bill payments and subscription renewals.

- A healthy credit score will no longer be sufficient in and of itself; it will need to be buttressed by consistent financial behavior.

What Borrowers Should Take Away

The key insight here is simple: a good credit score for personal loan approval isn’t a free pass. Without the foundation of a clean repayment history, the score loses much of its weight.

Instead of focusing solely on raising the number, borrowers should build habits that reflect reliability because, in the end, lenders care more about whether you will repay than whether you can.

Conclusion

Good credit is like walking around with a shiny business card; it’s a surefire way to get noticed. But what seals the deal is the story behind that, your history of repayment. Lenders are placing more value on being consistent and responsible than simply being high.

For borrowers, that means the road to advantageous loan terms involves a two-pronged approach: keep your credit score strong and your repayment record pristine. Combined, these do more than open the door to approvals but also to lower costs, bigger opportunities, and long-term financial health.